Do you ever wonder why the prices of commodities such as steel, cement fluctuations not? In part the answer lies in index Baltic Dry Index (BDI) – an important measure reflects the situation of shipping goods globally. BDI as a “radar” to help us track economic activity, from production to consumption. When BDI rising, that means the demand for transportation of goods, and vice versa. So, BDI what is and this indicator how does it affect freight ship? Let's find out in this article.

Index BDI what is?

Baltic Dry Index (BDI) is an important economic, reflect the price of shipping the commodity dry rough sea. This index is used as a tool to evaluate the situation of global economy, because it is based on the proportion of freight transport cargo on the ship not affected by speculative factors.

BDI is important indicator affecting freight ship

Index of BDI has historically formed how?

Index Baltic Dry Index (BDI) was born on 4 January 1, 1985, marked a turning point in the shipping industry when the Department of Baltic Trading in London announced this indicator, inherited from the index, the Baltic Freight Index (BFI) before that. BFI, with 13 routes shipping from fertilizer to coal, laid the foundation for the BDI.

This index was then developed to replace the BFI as a payment tool important for BIFFEX, based on the average of the three indicators is BPI, BCI and BHI. BDI quickly become the index representing the market dry goods global, reflecting the volatility of the demand and supply of sea transport.

Is a measure of the growth of the market of freight left on the sea

Through the years, BDI has witnessed series of changes in style and structure, from the selection of transport routes, the size and type of vessel, to the calculation of charges chartering the term. These adjustments not only help BDI more accurately reflect the market situation but also ensure transparency and fairness for the parties involved. You can learn more about the history of the development of this indicator in the website of the Baltic

Formula for calculating the index, BDI

Index of BDI is calculated by taking the average weighted price of chartering average over time of the different ship types. Calculation formula is as follows:

BDI = ((CapesizeTCavg + PanamaxTCavg + SupramaxTCavg + HandysizeTCavg)/ 4) * 0.113473601

In there:

- TCavg = Time charter average: the cost limit, the average (of each ship size Capesize, Panamax, Supramax, Handysize)

- 0.1,13473601 is a coefficient, for the first time is applied when the BDI replacement for the BFI, and this coefficient is changed according to the year when the index composition and calculation method is changed.

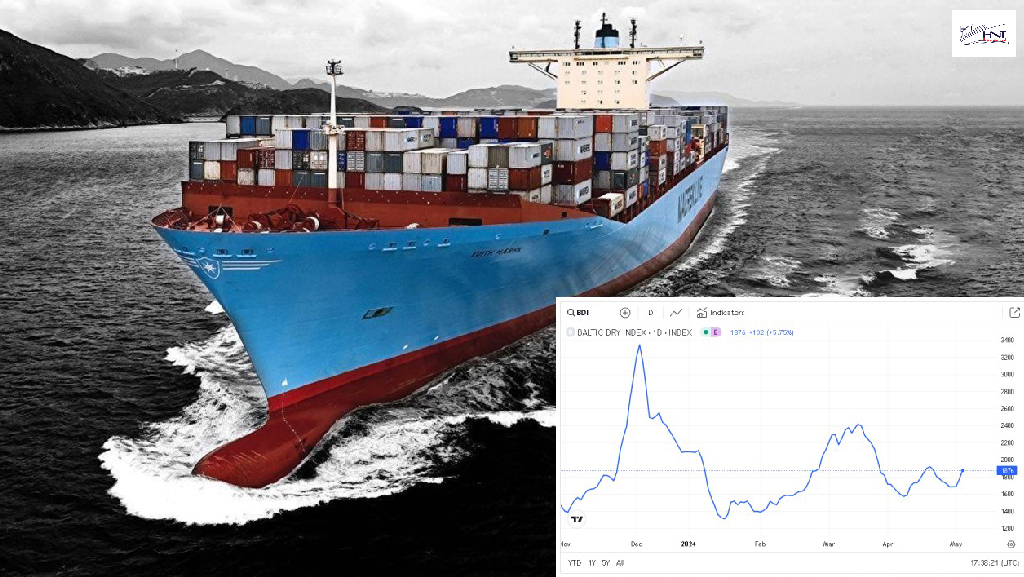

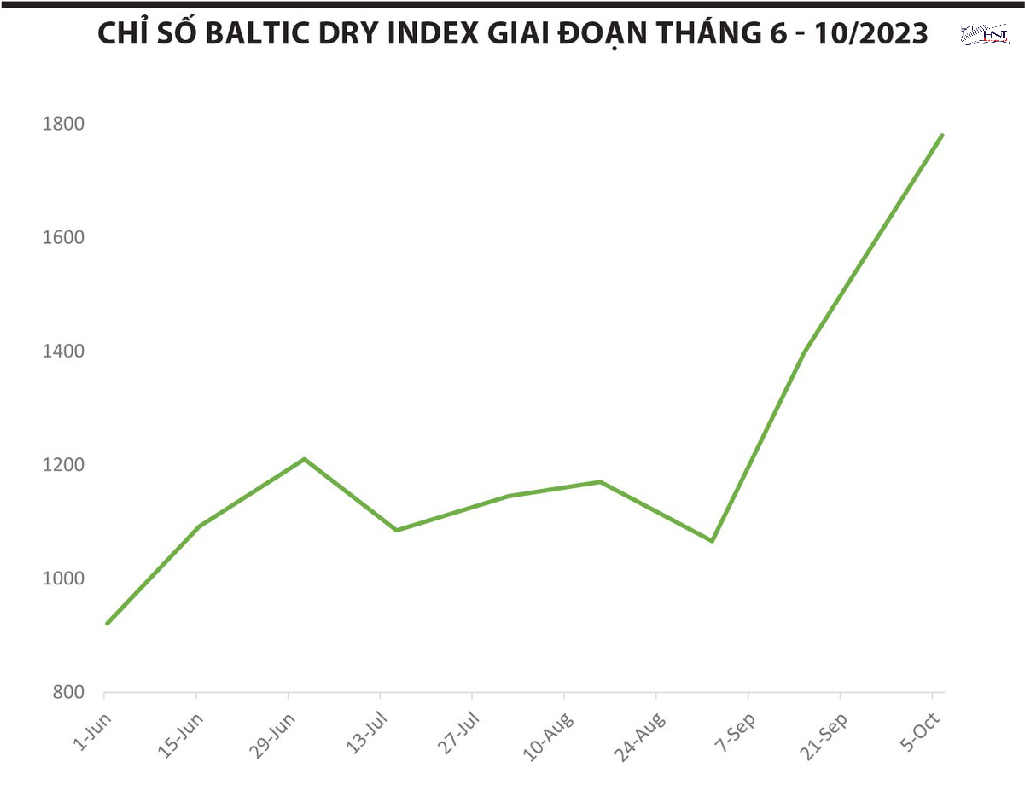

Based on the chart of the Baltic Dry Index can predict the trend of market

Index Baltic Dry Index is an indicator indirect demand and supply worldwide for the type of commodity transported by ships, including the basic raw materials such as construction materials, coal, iron ore and grain. Because of this cargo is usually the raw material input for the production of the intermediate product, and finally as cement, power, steel and food, the BDI is often considered a leading indicator, reflecting the growth of economic activity globally in the future.

The importance of BDI

Index of BDI has an important role in assessing the situation of global economy. It not only reflects the needs freight, but also is a sign of active production and consumption in the world. When the indicator BDI high, it shows the demand for transportation goods and vice versa. Therefore, only the number of BDI is also seen as an early indicator for economic trends.

See more: Top 5 Export Fruits of Vietnam

The selected transport routes in the history of the index, BDI

Routes sea transport is usually chosen based on the history of the BDI. At the time, October 10, 2010, the BDI is calculated based on 20 transport lines separate as in the table below.

| Online | Description | Weight |

| 4 Capesizes T/C routes (with 6 other voyage charter routes) to form BCI | ||

| C8 | 172000 mt Gibraltar/Hamburg trans Atlantic RV | 25% |

| C9 | 172000 mt Continent/Mediterranean trip Far East | 25% |

| C10 | 172000 mt Pacific RV | 25% |

| C11 | 172000mt China/Japan trip Mediterranean/Cont | 25% |

| 4 Panamax T/C routes to form BPI | ||

| P1A | 74000 mt Transatlantic RV | 25% |

| P2A | 74000 mt SKAW-GIB/FAR EAST | 25% |

| P3A | 74000 mt Japan-SK/Pacific/RV | 25% |

| P4 | 74000 mt FAR EAST/NOPAC/SK-PASS | 25% |

| 6 Supramax T/C routes to form BSI | ||

| S1A | 54000 mt Antwerp – Skaw Trip Far East | 12.5% |

| S1B | 54000 mt Canakkale Trip Far East | 12.5% |

| S2 | 54000 mt Japan – SK / NOPAC or Australia rv | 25% |

| S3 | 54000 mt Japan – SK Trip Gib – Skaw range | 25% |

| S4 | 54000 mt US Gulf – Skaw-Passero | 12.5% |

| S4B | 54000 mt Skaw-Passero – US Gulf | 12.5% |

| 6 Handisize T/C routes to form BHSI | ||

| HS1 | 28000 mt Skaw / Passero – Recalada / Rio de Janeiro | 12.5% |

| HS2 | 28000 mt Skaw / Passero – Boston / Galveston range | 12.5% |

| HS3 | 28000 mt Recalada / Rio de Janeiro-Skaw / Passero | 12.5% |

| HS4 | 28000 mt US Gulf / NC South America – Skaw / Passero | 12.5% |

| HS5 | 28000 mt SE Asia via Australia – Singapore / Japan | 25% |

| HS6 | 28000 mt, S Korea/Japan – S'pore/Japan range incl. China | 25% |

To note is information about the sea route is shown in the table above data is only accurate at the time of April 10, 2010. The structure of the BDI have been changed and will probably continue to change in the future. Exchange Baltic regularly update the information about these changes on their website, and you can access the updated files via the link that I have provided above.

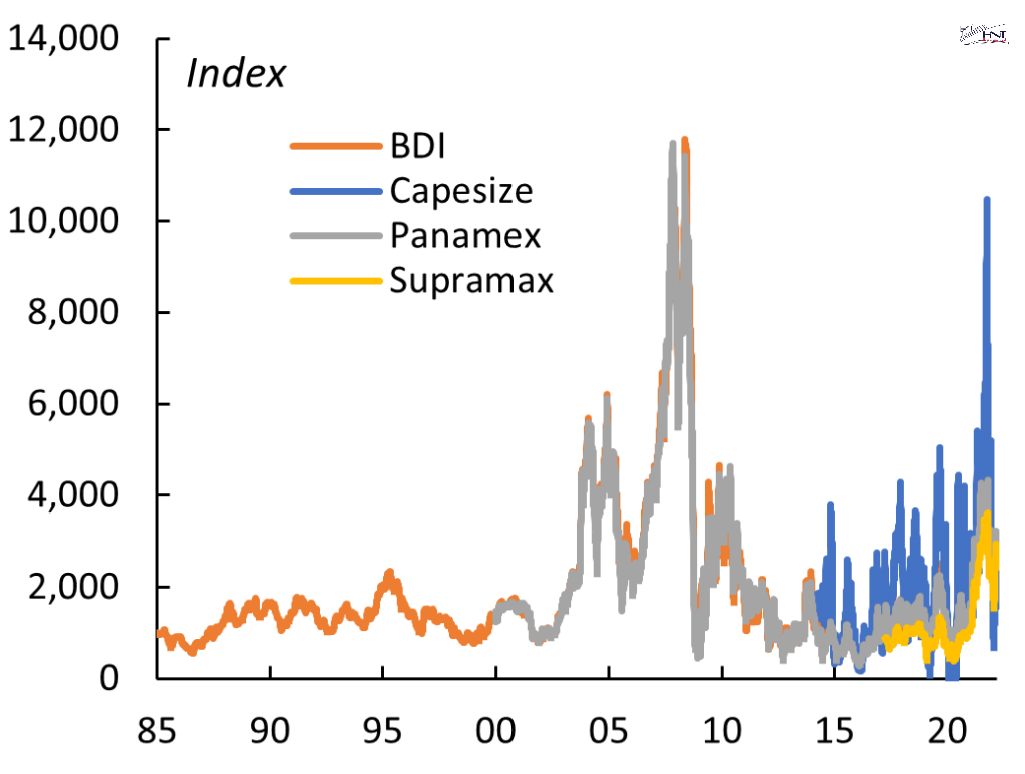

The chart shows 4 main indicators in the Baltic Dry Index

The BDI consists of four main indicators, each indicator reviews a type of ship dry bulk different sizes. Specific:

- BCI: Baltic Capesize Index

- BPI: Baltic Panamax Index

- BSI: Baltic Supramax Index

- BHSI: Baltic Supramax Index

Conclusions

Index, BDI, as a “compass” for investors, economists, and the shipping company to evaluate and forecast the market trends. It provides an insight about the structure of the global economy and is an integral part of the transportation industry sea.

If you are in need of transporting goods by container and want to learn more about the factors that affect the cost ship, please contact HNT Logistics. We will provide you the useful information and assist you in finding shipping solutions the most optimal.